Watching Data during COVID-19 with Eloquence on Alert

Eloquence on Alert is a powerful title performance monitoring tool for publishers. We collect data from major book and ebook websites daily, and provide that data in an informative interface that helps publishers catch issues, watch trends, and find opportunities.

Since the beginning of the COVID-19 crisis and the subsequent economic shutdown we have been watching carefully to see what kinds of trends would emerge. This page is an attempt to show you some of those trends, and to give some context to how the situation evolved over time. The data comes from about 35,000 of the titles we have been tracking for publishers on a daily basis. (Last updated 5/18/2020)

General Thoughts

The charts below tell an interesting story. While we are cautious about putting any kind of interpretation on the data ourselves, we would like to put a little bit of context on some of the dates in this timeline.

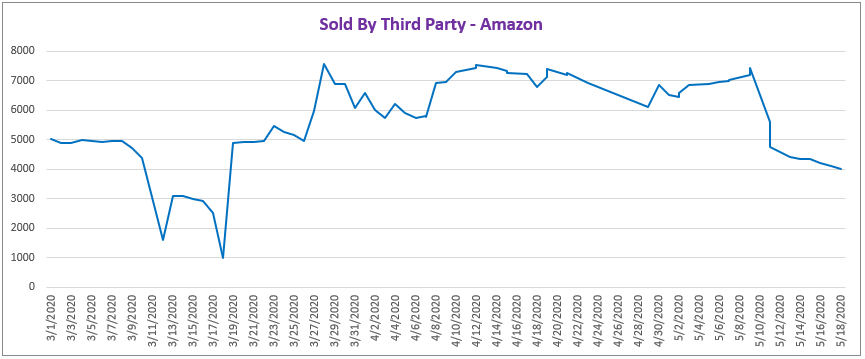

March 11: There was a sudden drop in third party sellers taking the buy box on Amazon, indicating that Amazon was selling more of its own stock. That was the same the day the World Health Organization “made the assessment that COVID-19 can be characterized as a pandemic”, and also the day that social gatherings over 250 people in Seattle, Washington, where Amazon is headquartered, were banned. This was extended to the entire state two days later.

March 17: There was an even further drop in third party seller activity, the day Amazon announced it was going to begin prioritizing essential products in its warehouses.

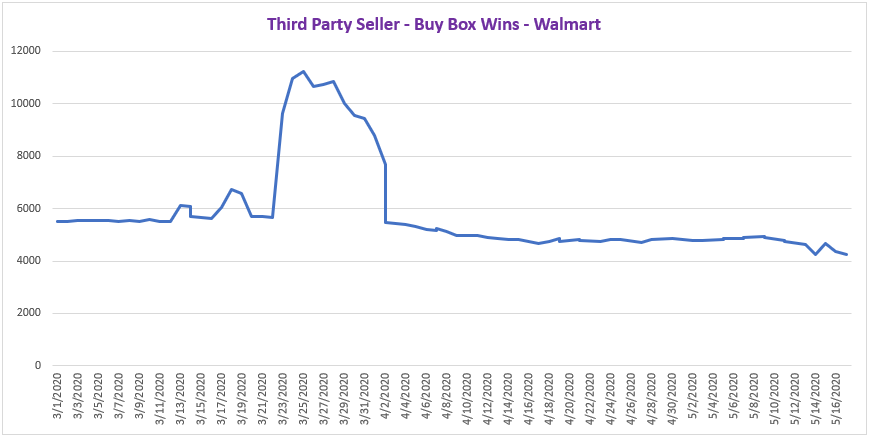

March 22: Walmart saw a major uptick in third party seller activity (see Chart 6). This was just one week after Walmart cut store hours and the day before the company announced a large hiring spree both for store and distribution employees. By April 4 these levels were back down to normal, more than one month before they returned to normal at Amazon (see Chart 1).

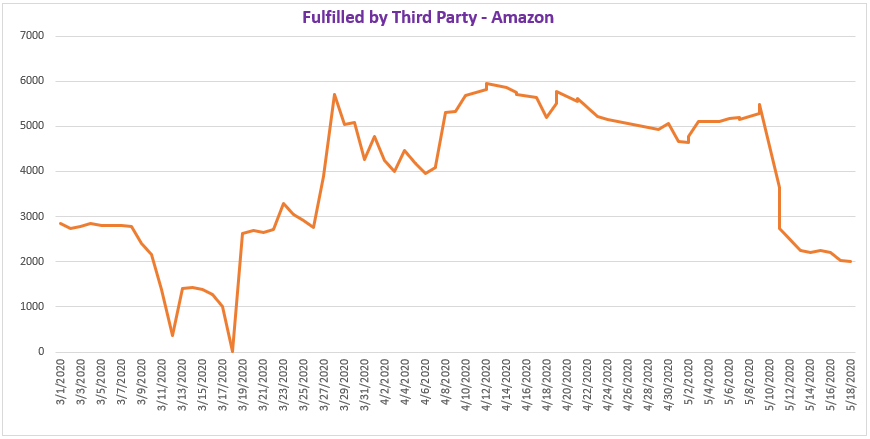

March 28: Third party sellers started taking the buy box for many more products on Amazon, specifically sellers that have their own distribution and were not using Fulfilled By Amazon (FBA) (see Chart 2).

April 28: Chart 3 shows a drop, and then a large increase, in the number of titles with delayed shipping messages at Amazon. Around the same time, the company was dealing with multiple outbreaks in its distribution centers and strikes among employees. Amazon also announced a pilot program to validate the identity of third party sellers using video conferencing.

May 9: There was a sharp decrease in third party seller activity again, about one week after we started hearing reports that Amazon had started ordering books from publishers again.

Chart 1: All Third Party Seller Buy Button Wins on Amazon — March 1 thru May 18, 2020

Chart 2: Third Party Seller Buy Button Wins where Seller Provides Fulfillment on Amazon — March 1 thru May 18, 2020

Chart 3: Delayed Shipping Messages at Amazon — March 1 thru May 17, 2020

The number of Amazon-sourced titles (not Third Party) where the Amazon Availability message contains “Available to Ship in…”, “In Stock On…”, “Ships within…”, or “Temporarily Unavailable…” (i.e., the product does not ship immediately, it ships in 2 days, 1 week, 3 weeks, etc.). The decrease around April 25-28 could be largely due to Amazon not listing ship times in the Buy Box for third party sellers.

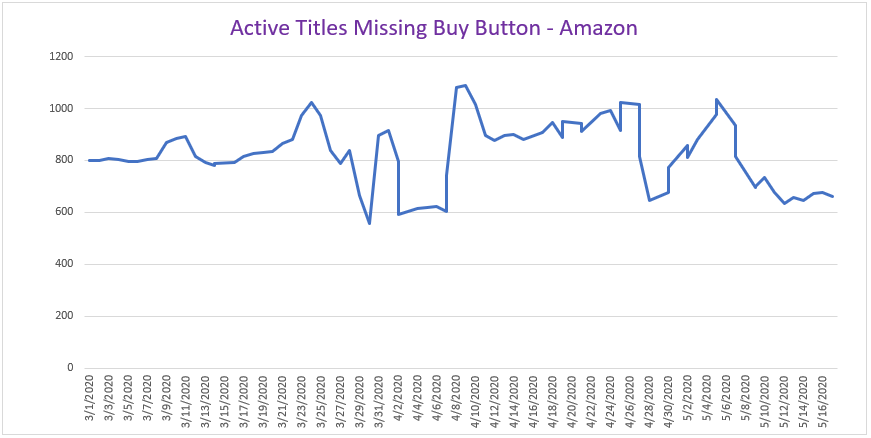

Chart 4: Titles missing Buy Button on Amazon — March 1 thru May 17, 2020

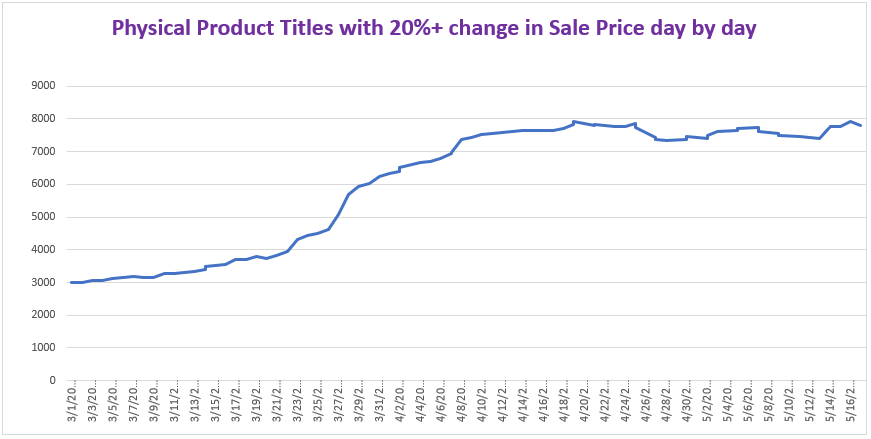

Chart 5: Price Volatility on Amazon — March 1 thru May 17, 2020

Amazon is playing around with the sale price of physical products more than before.

Chart 6: Third Party Seller Trends at Walmart — March 1 thru May 17, 2020

Walmart does not have the same scope of third party sellers as Amazon, but the company appears to have adapted to the situation more quickly.